Get everything you need to set your payroll on worry-free autopilot:

Our personalized support system assigns you a local Connected Service Representative who knows you and your business and will support all of your payroll needs. No more call centers.

Replace wasteful paper statements, avoid lost payments, and make payday easier on your employees with secure, online pay stubs and free direct deposit.

Run reports like year-to-date payroll details, payroll runs, and more with easy-to-use reporting and customizable fields to fit your needs.

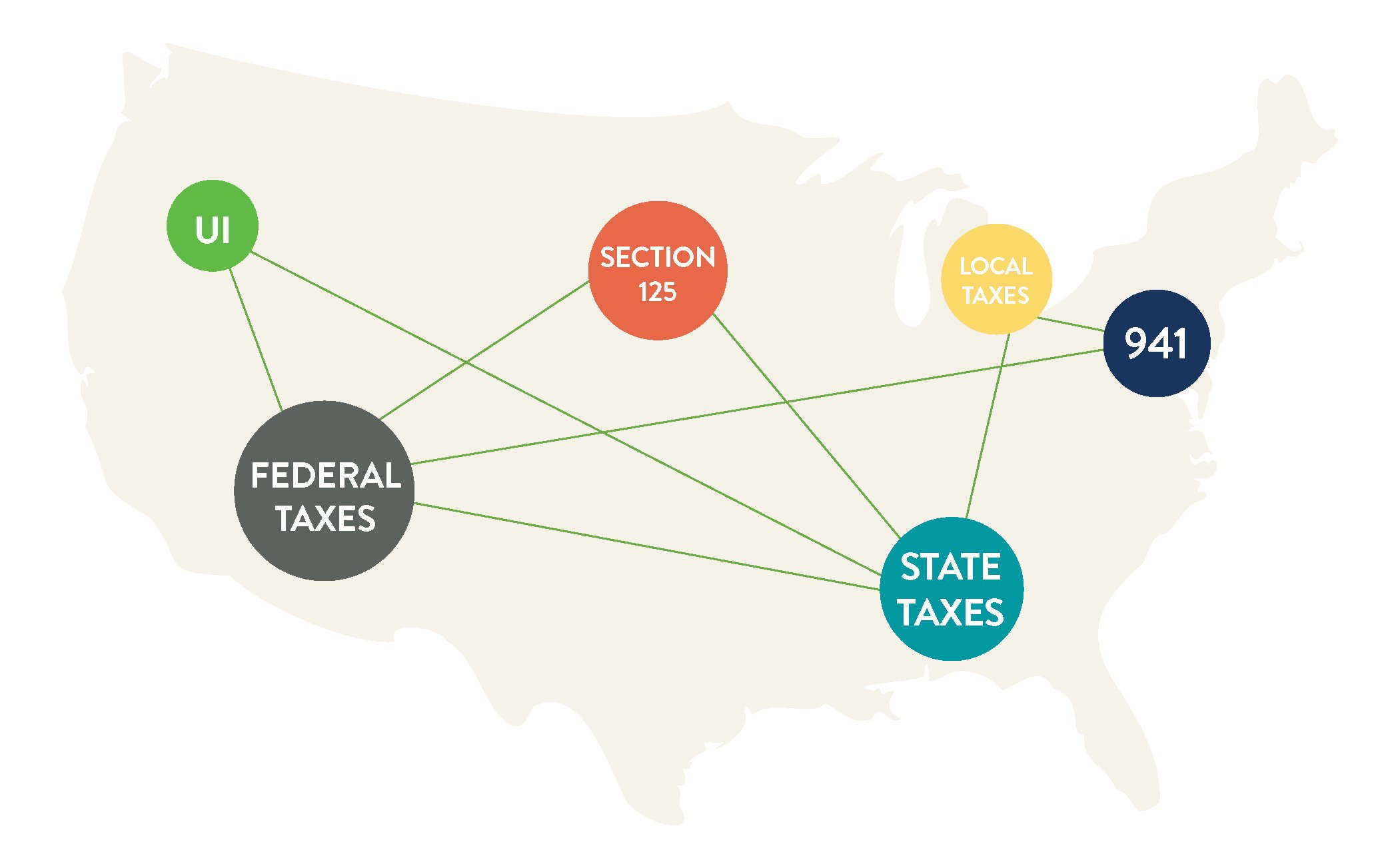

Never fear the IRS again. We guarantee that federal, state, and local payroll taxes are always filed on time. If they're not, any IRS fees or fines are on us.

With our Connected Payroll model, we seamlessly integrate your plan with our payroll, giving you the ability to pay-as-you-go.

Learn more about our Workers' Comp integrations.

Monitoring employee attendance and time tracking shouldn't be time-intensive. Now you can easily track employee attendance, vacation time, and sick days.

"ConnectPay simply cares about your business, they treat you like a partner not a client."

Spend less time worrying about your taxes and more time focusing on growing your business. We automatically process your payroll and record all taxes paid throughout the year. We can also automatically process tax payments. We guarantee that your payroll taxes are filed correctly and on-time. If not, we'll pay the IRS fees.

We keep you covered, compliant, and in control through Section 125. Your employees will enjoy paying for qualified benefit premiums before taxes are deducted from their checks. Plus, you can pre-qualify for:

"The system is very user friendly and our taxes are done in a timely manner, even working directly with my bookkeeper.”

ConnectPay was designed to provide your small business with the tools, connections, and flexibility to tackle all your payroll needs.

ConnectPay will never lock you in to long-term contracts. However, switching payroll should always be done on the quarter to coincide with the 941 report if possible. Switching on the quarter simplifies reporting with tax agencies, making it least likely to generate a tax notice.

ConnectPay will handle and file all Federal Tax forms as well as State Unemployment and State Income Taxes. We also support the growing list of Paid Family Medical Leaves at the state level. In addition, some jurisdictions have local taxes that we support.

Our Connected Payroll Representatives work very hard with our onboarding team to ensure switching is as smooth as possible. To facilitate the transition, it is important to have access to your Unemployment and State Department of Revenue accounts.

Our systems are designed for flexibility. We can adapt to when and how often you need to process payroll, as well as add or remove employees from your payroll as the situation arises.

Add or remove services at any time by contacting your Connected Service Representative.

When you connect with us, you’ll get:

“When we switched to ConnectPay, I did not go along happily because I thought my situation was fine.

Much to my surprise, my Connected Rep made my job so much easier.”