State-by-State Breakdown of Pay Transparency Laws for CPAs

The national conversation around pay transparency has grown louder over the last few years, and it’s going to continue to be a top payroll issue for small businesses in the coming years. CPAs will play an important role in helping small business clients comply with an ever-growing number of pay transparency laws.

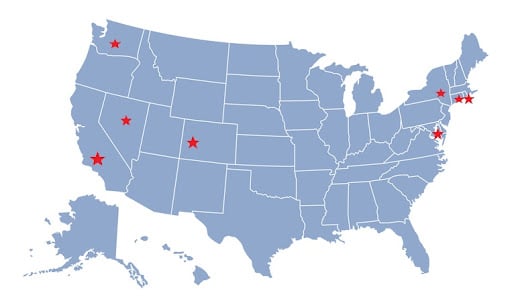

Seven states currently have pay transparency laws in action, with an eighth state’s law set to become effective later in 2023. At least 15 more states are considering pay transparency laws. There’s been movement on the federal level as well: The “Salary Transparency Act” (H.R. 1599) was recently introduced to Congress by Representative Eleanor Holmes Norton (D-DC). The bill would require employers to disclose wage ranges in all job postings, both publicly and internally. Employers would also be required to tell current employees about the wage range for their specific positions, both upon an employee’s hiring and once per year thereafter.

CPAs can be a tremendous resource to business owners, and not only by educating them about relevant pay transparency laws and advising them on compliance. CPAs can also use pay transparency conversations to create value for clients by seizing the opportunity to analyze and refine their compensation practices.

However, tracking all the different state-level pay transparency laws can get complicated very quickly because they’re all slightly different. Some states’ laws clearly apply to out-of-state employers that hire remote workers, while others don’t. Having a clear understanding of what the various laws require is a good jumping-off point for CPAs who need to guide clients through pay transparency issues. Here is a state-by-state breakdown.

States with Current Pay Transparency Laws

California

Applies to: Any California employer with more than 15 employees or any employer with at least one employee in California.

Covered employers must disclose pay scale information in any job postings. Non-California employers hiring for remote positions must comply with the law if a job posting could be filled by a California resident. There are also reporting requirements for employers with 100+ employees.

Colorado

Applies to: Any employer with at least one Colorado employee.

The first state to enact pay transparency laws, Colorado’s laws are expansive. Job postings must include pay scale information as well as descriptions of all other compensation and benefits. The law covers remote positions that could be filled by Colorado employees.

Connecticut

Applies to: All employers in Connecticut and those with at least one employee in Connecticut.

Covered employers do not have to disclose pay range in job postings but must provide it upon a job applicant’s request.

Maryland

Applies to: Any employer that is “engaged in business” in Maryland.

Covered employers are not required to disclose salary range in job postings but are required to provide it upon an applicant’s request. Employers may not ask candidates for wage history through any means.

Nevada

Applies to: All employers in Nevada.

Covered employers aren’t required to disclose pay information in job postings but must automatically provide it after a candidate’s first interview. Inquiring about a job candidate’s wage history is forbidden.

New York State

Will apply to: Employers in New York State with at least four employees.

While pay transparency has been mandated for New York City employers since 2022, New York’s statewide pay transparency law is set to take effect on September 17, 2023. Barring changes before then, covered employers will be required to include both the salary range and job description in any ads for any job that will be physically performed in the state.

Rhode Island

Applies to: All employers with one or more employees in Rhode Island.

Covered employers aren’t required to disclose pay information in job postings but must disclose salary range upon an applicant’s request.

Washington State

Applies to: Any employer with 15+ employees that includes at least one employee in Washington.

Covered employers must disclose salary range in job postings.

More Things to Know About Pay Transparency Laws

In addition to New York City, a few other cities have passed their own pay transparency laws. The list includes Jersey City, NJ; Ithaca, NY; Toledo, OH and Cincinnati, OH.

And what about the future of state-by-state pay transparency laws? More than a dozen states also currently have some kind of pay transparency law under consideration, including Illinois, Massachusetts, New Jersey and Virginia. It’s likely that any laws passed in those states would be similar to the pay transparency laws already on the books in other states. For example, one bill proposed to the Massachusetts legislature would require Massachusetts employers with 15+ employees to disclose pay range in job postings and create reporting requirements for larger employers.

Pay Transparency Law Takeaways for CPAs

- CPAs may wish to advise clients to err on the side of proactive transparency around pay because pay transparency laws can get complicated (especially for employers open to hiring employees in other states). Clients who choose to a) include salary ranges/other compensation information in every job posting, and b) not ask for applicants’ salary histories, are probably going to be compliant with every state’s pay transparency laws. (Yes, sharing salary ranges upfront might mean some top candidates won’t apply, but clients save time by not going through the interview process with applicants whose salary requirements aren’t aligned!)

- Pay transparency can generate opportunities for CPAs to create value for clients. Not just by helping them avoid penalties but by working with them to document salary ranges and look critically at how pay decisions are made. Bringing in a consultant to do a compensation study can be illuminating too. If there are any biases in the way clients pay employees or improvements that could be made to their compensation structures; it’s in everyone’s best interest to find them now.

-

Pay transparency laws are increasing and will likely be adopted by more states. Businesses can expect job candidates to become increasingly aware of their rights around pay equity and transparency. CPAs should urge clients to proactively refine their compensation practices to help them attract and retain the best workers for long-term success.

Have Questions About Pay Transparency Laws?

CPAs who are part of ConnectPay’s Accountant Partnership program can get answers to any payroll-related questions with a phone call to their Connected Services Representative. Whether you have specific questions about pay transparency laws or need to resolve some other payroll/tax issue, someone will always pick up when you call during business hours. We’ll get you the answers you need so you can focus on serving your clients. Want to learn more about how ConnectPay can make payroll easier? Let’s connect today.