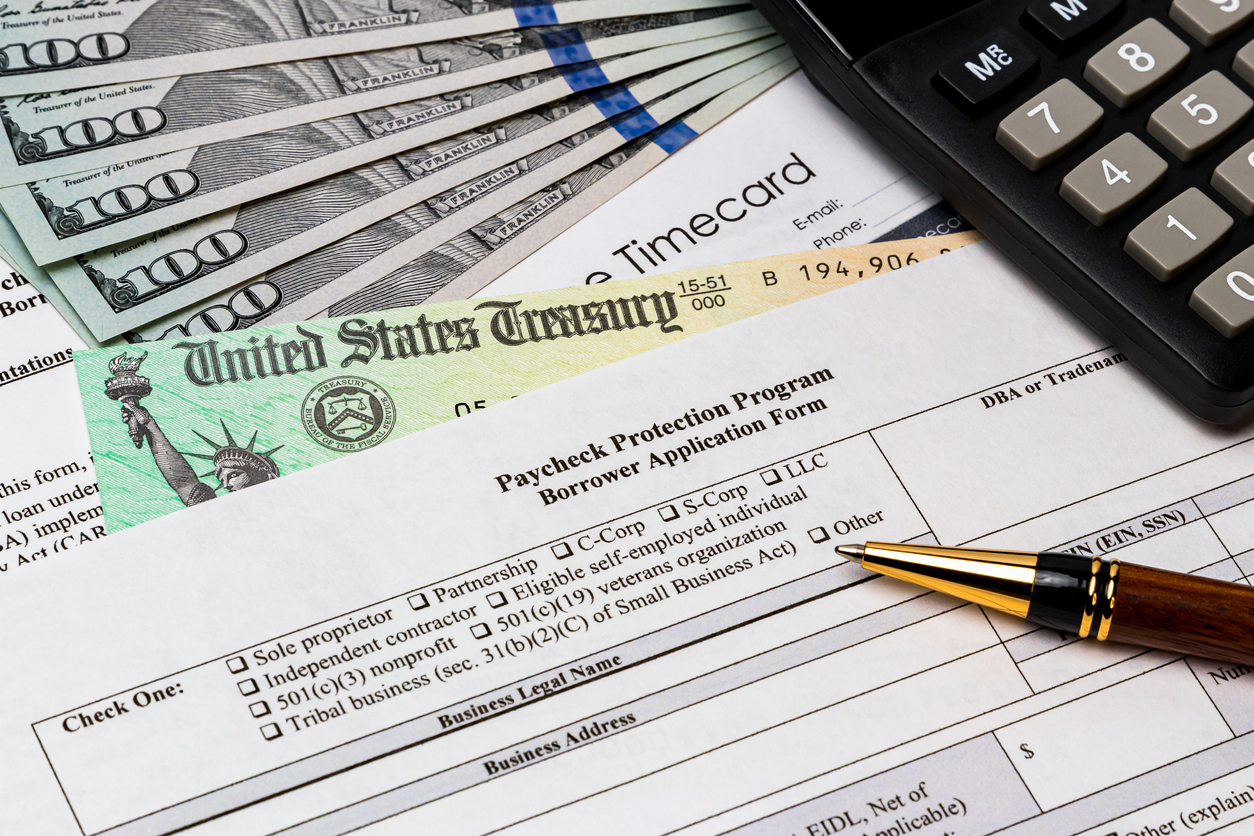

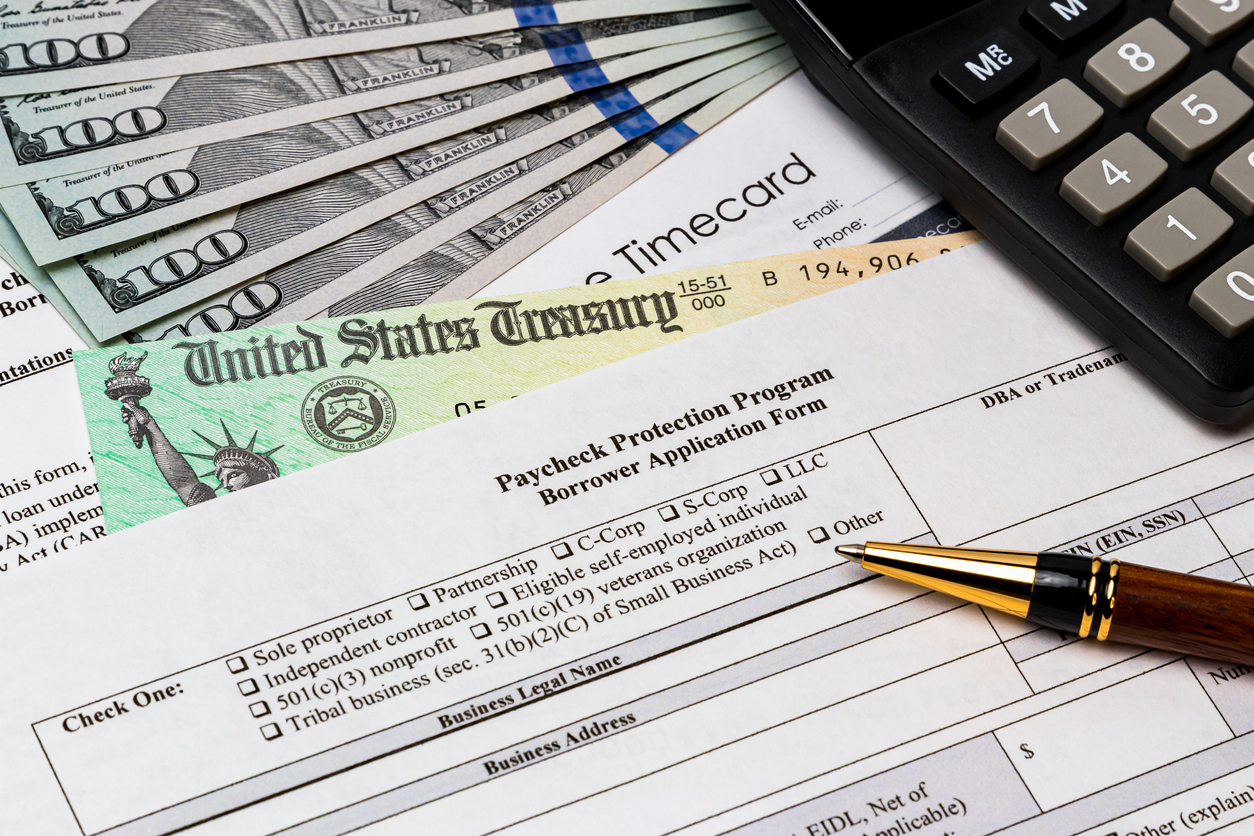

On Thursday, March 25th, the Senate passed the PPP Extension Act of 2021, voting to extend the Paycheck Protection Program application deadline from March 31st to May 31st. This act, passed by a landslide vote of 92-7, is expected to be signed into law by President Joe Biden.

The benefits of the PPP Extension Act are two-fold: small business owners will now have two more months to apply for COVID-relief while the Small Business Administration will be given an additional 30 days to process its backlog of almost 200,000 pending PPP applications.

However, despite this extension, applying for PPP should still be a top priority for any small business that suffered a 25% decrease in gross receipts for any quarter in 2020 as compared to the same quarter in 2019. For more information on PPP, including how to apply, qualifications for loan forgiveness, and a breakdown on how PPP works with ERC, we encourage you to watch our on-demand webinar below. Should you have any further questions, please reach out to your CPA!