How To Fill Out The New W-4 Form (In 5 Easy Steps)

In December of 2020, the IRS released a redesigned version of Form W-4, attempting to simplify the process for employees when they start a new job. According to the IRS, “while [the form] uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees.” The overarching goal of the new W-4 is to reduce complexity while simultaneously increasing the accuracy of withholding information.

In an effort to provide better transparency, withholding allowances will no longer be used for Form W-4 and employees cannot currently claim personal or dependency exemptions. However, it’s important to note that at ConnectPay, our payroll platform will continue to support the allowance format.

How To Fill Out The New W-4

Keep in mind that existing employees who’ve already submitted their W-4 prior to 2020 will not need to submit a new one. However, for those that need to complete the new W-4, it can be filled out in five simple steps. Depending on individual tax circumstances, you may not need to fill out every section.

Below is a detailed explanation that walks you through the process. If you’d like to follow along, you can download the latest version of Form W-4 here.

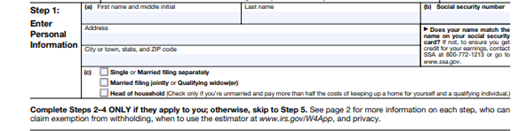

Step 1: Enter Personal Information

This includes basic information like your first and last name, social security number and address. Also make sure to check the box that best defines your filing status, depending on whether you’re single/married and filing separately, married and filing jointly/a qualifying widow, or the sole head of your household. If you’re unsure which box to choose, the IRS defines each category on its website.

Step 2: Multiple Jobs or Spouse Works

This section of the form only needs to be completed if you work multiple jobs OR if you checked the “Married Filing Jointly” box and your spouse also works.

If you are required to fill out step two, you have three different options to choose from

Option A: Use the estimator at www.irs.gov/W4App and answer the series of questions to calculate your withholding.

Option B: Use the Multiple Jobs Worksheet provided on page 3 and enter the results in Step 4(c) for a roughly accurate withholding.

-

-

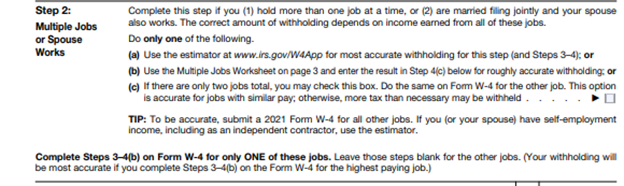

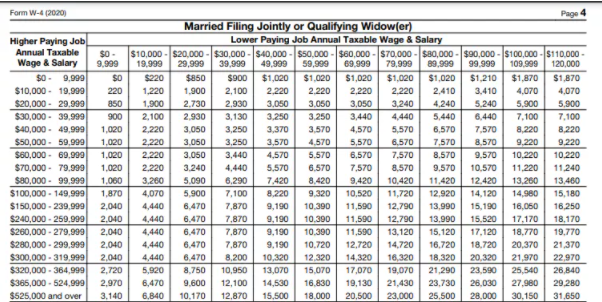

- Line 1: Fill out this line if you have two jobs or if you’re filing jointly and you and your spouse each have a job. You will need to locate the intersection between your highest paying job (use the Higher Paying Job row) and your lowest paying job (use the Lower Paying Job column) with the table provided on page 4.

- Lines 2a-2c: Fill out these lines if you and/or your spouse have three jobs at the same time.

- Line 2a: Locate the intersection between the annual wages of your highest paying job (use the Higher Paying Job row) and second highest paying job (use the Lower Paying Job column) by referencing the table on page 4.

- Line 2b: Add the annual wages of your two highest paying jobs together and find this number on the Higher Paying Job Row on page 4. Then locate the annual wages of your third job on the Lower Paying Job column to record the intersection value.

- Line 2c: Simply add 2a and 2b together.

- Line 3: List the number of pay periods per year for the highest paying job

- Line 4: Divide either line 1 or line 2c by the number of pay periods listed on line 3

-

Option C: If you only have two jobs to report in total, you can check the box provided and fill out a Form W-4 for the other job, where you must also check the box. Only choose this option if the jobs are similar in pay - otherwise, more tax than necessary may be withheld.

Step 3: Claim Dependents

If your total income is $200,000 or less, or if you’re married and filing jointly with a total income of $400,000 or less, then you will need to fill out this section.

First, multiply the number of qualifying children you have under the age of 17 by $2,000. For example, if you have three children under the age of 17, you should write $6,000 on the line. Next, multiply the number of other dependents by $500. Add these two lines together and enter the sum on line 3.

Please note that when processing payroll, the amount listed in Step 3 will be divided by the number of pay periods in your payroll frequency. Then, your federal tax deduction will be reduced by this amount.

Here's an example: If you wrote $6,000 on the line and you're on a weekly payroll frequency, you would divide $6,000 by 52 weeks, which gives you $115.38. This means that your federal tax deduction would then be reduced by $115.38. So, if your typical tax deduction is $200, it would now be $84.62 instead.

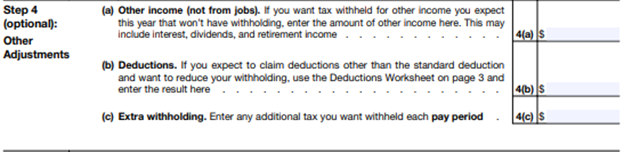

Step 4: Other Adjustments

This is an optional step that will need to be filled out if you:

a) have other income outside of the jobs previously listed

b) need to claim more than just the standard deductions (use the Deductions Worksheet on page 3 to calculate)

OR

c) there’s additional tax you want withheld each pay period

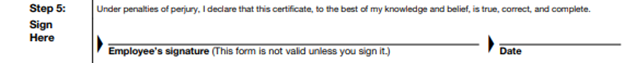

Step 5: Sign Here

Employees will need to sign and date the form, certifying that all information is filled out correctly.

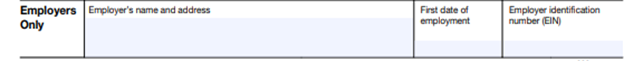

Employers will need to fill out their name and address, the employee’s first date of employment, and their Employer Identification Number (EIN).

Need more help?

It’s important to be able to navigate your employees through Form W-4 correctly – it will help you avoid employee frustrations down the line! If you’re a ConnectPay client, we encourage you to reach out to your Payroll Specialist with any questions you may have. If you’re a small business owner who needs additional compliance support, please feel free to reach out to one of our payroll representatives anytime.