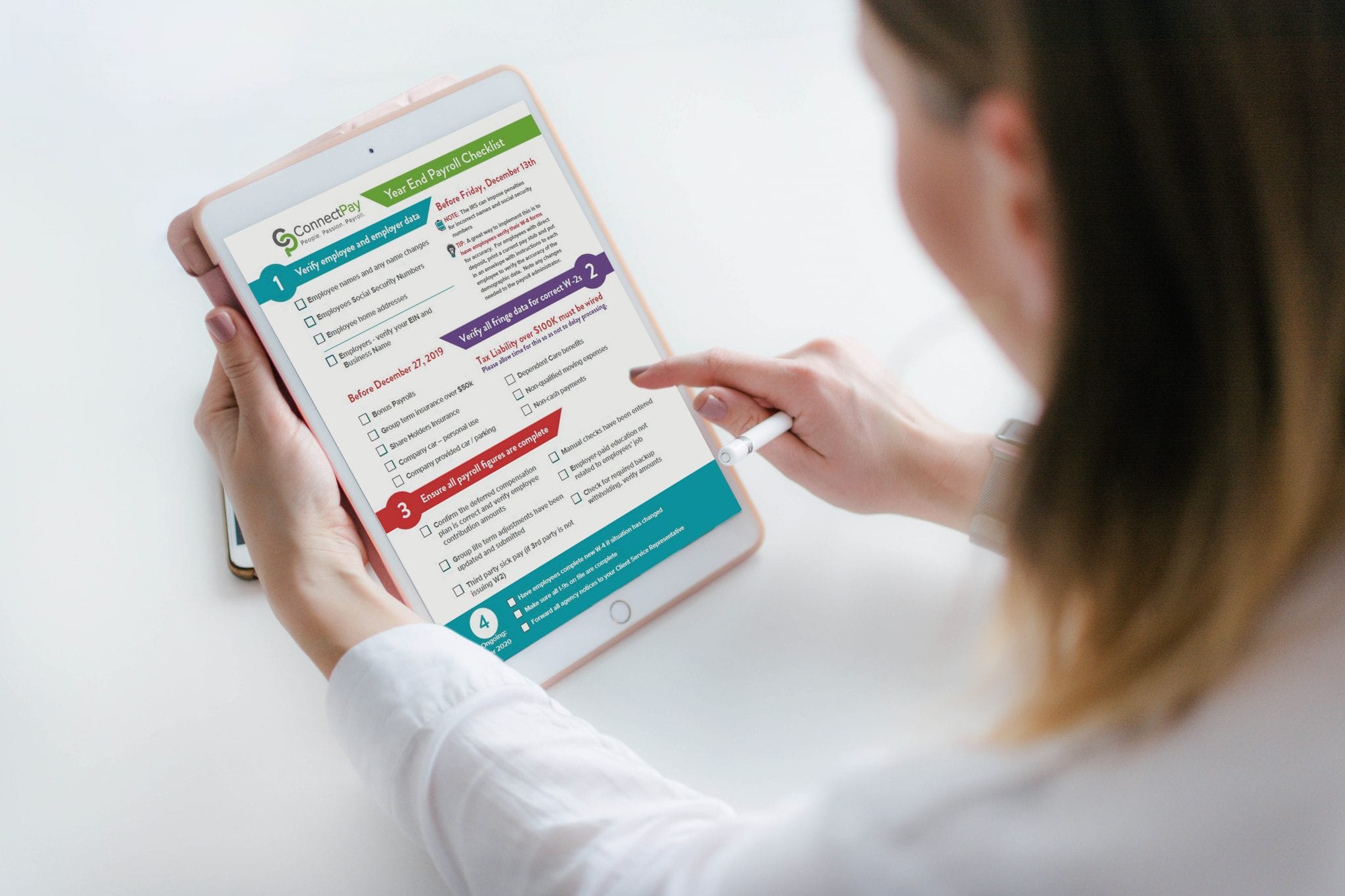

December is a time to be festive, relax with friends and family, indulge in delicious holiday-party fare — and, on a more practical note, time to get your payroll in order before the end of the year. Slightly less merry, but equally important! To help ease your burden, please find below ConnectPay’s handy checklist of payroll to-dos so you can get all your ducks in a row by year’s end — and still have plenty of time to celebrate and be merry.

6 Things to Do Before December 15

- Verify the employer address and ID number used to process W-2s.

Before you mail out your W-2 forms to employees, make sure your business address and federal ID number listed on the forms is correct. This might sound obvious, but if your company moved its headquarters this year, for instance, this is one of the things that has the potential to fall through the cracks — make sure it doesn’t.

- Confirm that all employee demographic information is correct: names, Social Security numbers and home addresses.

Make sure to get in touch with your employees to have them double check that their names are spelled correctly, and that their Social Security numbers and addresses are correct on their W-2s. While it’s ultimately the employee’s responsibility, it’s a nice courtesy for small businesses to reach out to their staff members and make sure everything is right.

- Schedule any separate bonus payrolls.

When issuing end-of-year or holiday bonuses, if you do plan to issue separate bonus payrolls and you want them to be applied on this year’s W-2s, you have to remember to add them in since they’re not part of your employee’s regular paychecks. Pro tip: You may even want to remind employees that bonuses, too, are taxed, just as regular paychecks are, something employees often don’t realize.

- Determine whether all adjustments are applied or that adjustment payroll is scheduled.

Ideally, these are things that should already be in place, but you just want to double check that they are. Make sure any adjustment payrolls are in by this date. If you issued an employee a pay increase, for instance, and it took them a minute to realize they never got their raise, you want to set the record straight before the end of the year so the change is properly reflected on their taxes.

- Confirm that all manual checks written during the year have been accounted for in the system.

For this one, you want to make sure that if you handwrote someone a check — perhaps because they were accidentally skipped off payroll one week and they needed the money, or you were reimbursing them for office supplies they purchased — enter it into the system so it’ll be included on your employee’s W-2 as part of their wages.

- Determine that all voided paychecks have been accounted for in the system.

This one is pretty straightforward. If you paid an employee in error and needed to void a check, make sure that’s been taken care of on time so it doesn’t accidentally factor into their W-2.

3 Things to Do Before December 28

- Confirm deferred compensation plan type is correct and verify employee contribution amounts.

Whether your employees have a 401(k), Roth IRA or SIMPLE IRA, you want to make sure you have the correct plan type listed for them, and that all their contribution amounts are correct. And remember, if an employee wants to max out their 401(k), the limit is $19,000 a year, so keep an eye on their contributions and make sure they don’t reach the limit before the year’s end.

- Ensure that the following have been updated, submitted and correctly coded on your employees’ W-2s: personal use of company vehicles; and company-provided transportation or parking.

Whether you’ve given an employee access to a company vehicle, or you’re paying for their car lease or parking, these are different line items on the W-2 so you want to make sure they get coded correctly.

- Make sure third-party sick pay has been updated and submitted.

If an employee is out on a worker’s compensation case and being paid by a third party, call the party in advance and ask them to send their paperwork over early so it can be entered on your employee’s W-2 as part of their wages. Oftentimes, when left to their own devices, third parties will send their paperwork out in January, but by that time, it’s already too late and amendments will have to be made, which cost money. Pro tip: You can even ask your employee to send records of their earnings in real time rather than waiting to get a summary at the end of the year, and chance missing it.

Feel free to download our handy end-of-year checklist here. If you have any questions or find yourself stuck while filling out your year-end paperwork, remember you can always turn to the team at ConnectPay for help. And in the meantime, happy filing.